Jack Bogle and The Bogleheads

So who is Jack Bogle anyway? And why does he have such a following that they have been officially dubbed the Bogleheads? And why have I chosen to follow this guy? He is supposedly “anti-crypto” after all, right?

When I first became involved in cryptocurrency, I quickly discovered that majority of investors had zero knowledge of equity investment, let alone personal finance or retirement plans. So I chose to stop drinking from the Kool-Aid and do something about it. I had been a self-proclaimed Boglehead for over ten years, so combining Boglehead principles within the cryptocurrency market just made sense to me. So though Jack Bogle maybe “anti-crypto”, his time-tested fundamental investment principles certainly are not.

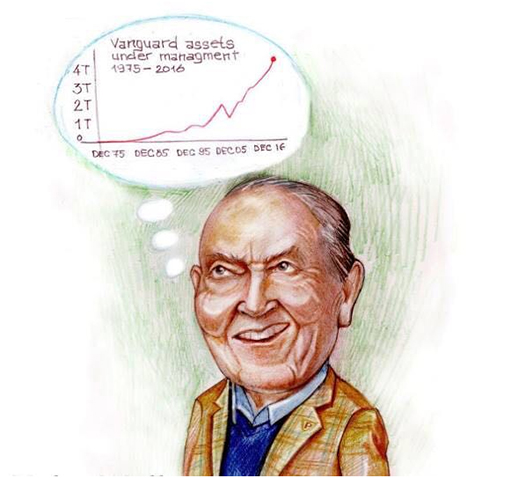

John Clifton “Jack” Bogle (born May 8, 1929) is an American investor, business magnate, and philanthropist. He is the founder and retired chief executive of The Vanguard Group.

His 1999 book ‘Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor’ became a bestseller and is considered a classic within the investment community. He is considered the “GodFather” of mutual fund investing. Before him, Mr. Average Joe investor didn’t stand a chance against Wall Street.

Now with the utilization of mutual funds and, more recently, exchange traded funds, average investors now can not only compete with high-frequency trading Wall Streeters, but we can actually win. The reason being is we can now own the entire market and be optimally diversified via these investment vehicles with very little initial capital.

Not only did Bogle trail blaze a new path for smarter, wiser investing, he built it into the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world; The Vanguard Group, with over $5 trillion dollars in AUM to date.

In 1951, for his undergraduate thesis at Princeton University, John C. Bogle conducted a study in which he found that most mutual funds did not earn any more money than if they invested in S&P 500 stock market index. Even if the stocks in the funds beat the benchmark index, management fees reduced the returns to investors below the returns of the benchmark.

It was born from these ashes that The Vanguard Group was formed, committed to the lowest fees in the business for pure benefit of its clients.

To no surprise, this was well received by Mr. Average Joe investor. So well that a cult following literally followed Jack everywhere. Eventually, Jack lost his tail, but that tail eventually grew into one of the largest unofficial, official investment collectives in the world; The Bogleheads.

In 1998, early Boglehead pioneers (then called Morningstar Vanguard Diehards) Taylor Larimore and Mel Lindauer created a forum which later gave birth to Bogleheads.org. This website is now the largest not-for-profit investment site on the Internet. Well, it was skies the limit from there.

The Bogleheads community now encompasses the forum, the wiki, a presence on Facebook, an investment blog, and The John C. Bogle Center for Financial Literacy. They have published three investment books: The Bogleheads’ Guide to Investing; The Bogleheads’ Guide to Retirement Planning; and The Bogleheads’ Guide to the Three-Fund Portfolio.

To be a Boglehead requires no special initiation or secret handshake. It just requires commitment and practice to the following steadfast investment principles:

1 Develop a workable plan

2 Invest early and often

3 Never bear too much or too little risk

4 Diversify

5 Never try to time the market

6 Use index funds when possible

7 Keep costs low

8 Minimize taxes

9 Invest with simplicity

10 Stay the course

Easy right? Not so fast. This is one of those things that takes two seconds to read, but a lifetime to master. I’ve been a self proclaimed Boglehead since 2006, and I still feel terribly inadequate in my practice.

But it has made me more wealth then I could have ever imagined at this juncture in my life. So I can’t really complain. I am living proof that with just a little bit of determination to learn, a will to practice, and an ability to stay humble can, and will, lead you to the promise land. So the fact that Jack maybe anti-crypto is irrelevant to me. His method works.

Do you like what you hear? Great. I did too.

Now, whether any of this can carry over to cryptocurrency successfully has yet to be determined. But in my mind, many of these teachings are basically universal for all aspects of life in general. So I’m pretty sure crypto would be included in that.

It’s early on, but I have already had success in constructing a crypto portfolio based in large part by what I’ve been taught as a Boglehead. I’ve been transparent with this approach in all my blog posts on the Internet and within Facebook crypto groups. It’s been well received by many, you all included.

So if you ever come across the CryptogleHeads in your daily web surfs and wonder who are we?

WE are Crypto.

WE are Bogle.

WE are Cryptogle.